Betalingsløsninger

Ressurser

Logg inn som privatperson

Fortsett i nettleserenLogg inn for å få en oversikt over dine kjøp, og betal dem enkelt med ett klikk!

Logg inn som bedrift

Logg inn for å administrere dine ordrer, utbetalinger, statistikk og generelle innstillinger.

Finansering

Tilby betaling opp til 36 måneder.

Å legge til finansiering som et alternativ i kassen, gir kundene dine en mulighet til å spre kostnadene over tid. Og betale i sitt eget tempo. Dette betyr økt kjøpekraft - noe som gir deg mer salg.

58%

økt gjennomsnittlig ordreverdi.

30%

høyere konvertering i kassen.

Slik fungerer det.

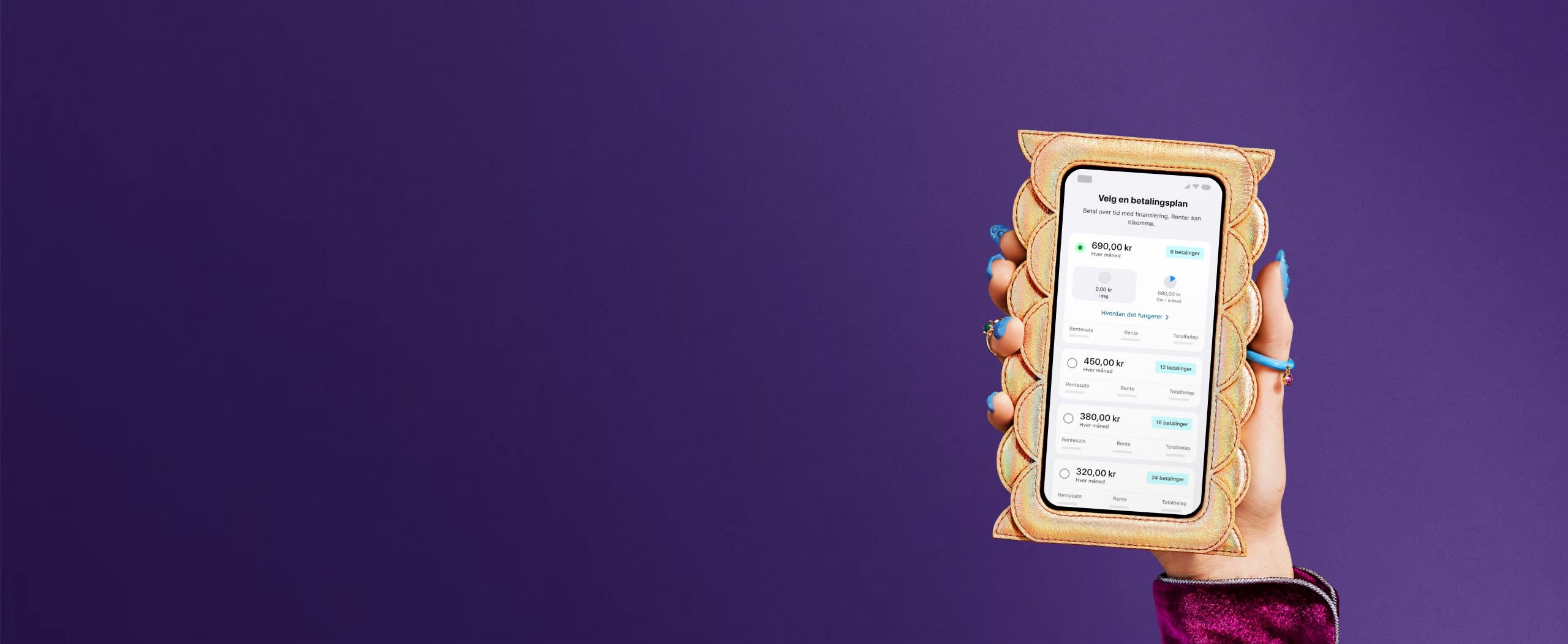

Finansieringsalternativene våre er designet for dagens kjøpere - og gir dem flere måter å kjøpe online i butikken din. Månedlig finansiering hjelper kundene dine til å betale over 3–36 måneder.

Nettsurfing

Kundene dine ser både hele prisen på en vare og den minimale månedlige kostnaden når de betaler med finansiering.

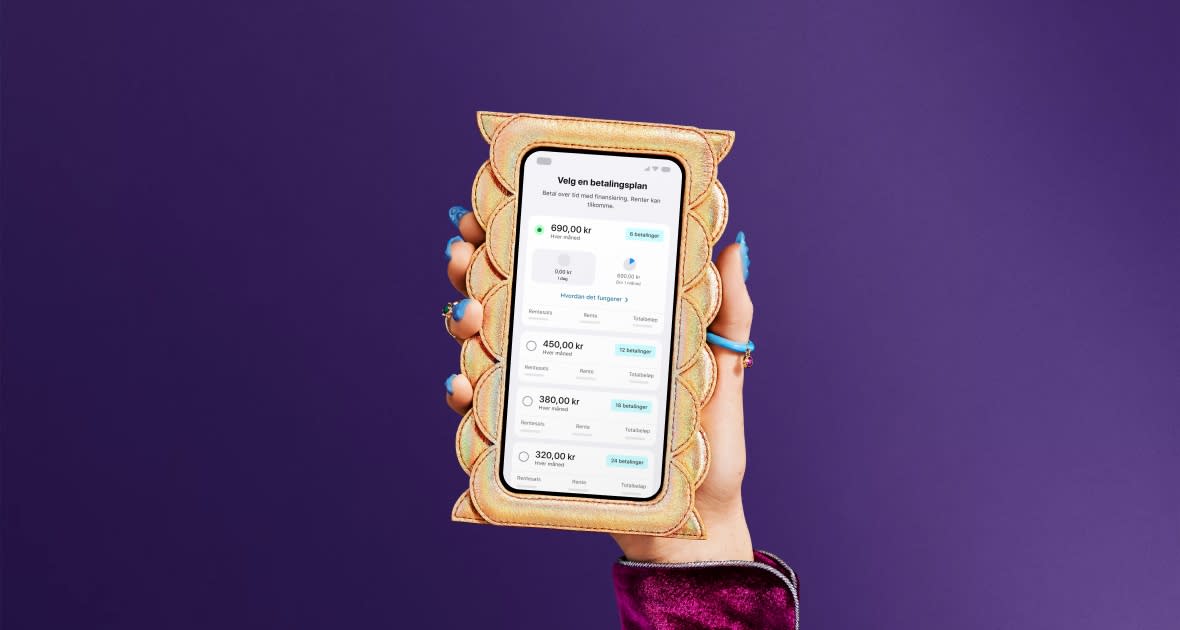

I kassen

Kunden din velger finansiering, fullfører en enkel engangssøknad og får svar med en gang, uten å oppgi kortdetaljer.

Betaling

Kunden din betaler enkelt sine månedlige innbetalinger til Klarna i appen vår eller på nett. Du får alltid betalt alt på forhånd, selv om vi ikke gjør det.

God kundeopplevelse hele veien.

Uansett om du er kunde eller butikk, så er du trygg. Vi tar full svindel og kredittrisiko for butikken, samtidig som vi gir full beskyttelse til kunden. Kunden får kontroll og oversikt med Klarna appen, der man får alle kjøp på et enkelt sted. Med appen kan kundene dine administrere kjøp, velge betalingsmåte, chatte med kundeservice 24/7 og til og med melde returer. Før neste betaling skal betales, sender vi en vennlig påminnelse så man slipper purregebyr.

Du kan tilby tre fleksible måter for kunder å dele kjøpet over tid.

Ingen renter når det betales i sin helhet

Kunder foretar månedlige betalinger innen tilbudsperioden på enten 6 eller 12 måneder. Renter belastes fra konteringsdatoen hvis det ikke betales i sin helhet.

Planlagte betalinger

Planlagte og faste betalingsbetingelser mellom 3–36 måneder til redusert årlig promotert prosentsats.

Den smooothe kredittsøknaden gjøres med bare to opplysninger, uten at kunden noen gang forlater nettsiden. Det er superenkelt og mobilvennlig, og gjør at vi er langt foran vår konkurrenter.

85%

av brukerne sier at Klarna er en bedre opplevelse enn andre online checkouts.

30%

av brukerne sier at de bare fullførte kjøpet fordi finansieringsalternativet vårt var tilgjengelig.

Integrasjon.

Hvordan du integrerer, avhenger av om du ønsker å oppgradere hele kassen eller bare legge til betalingsmåten i den nåværende kassen. Du kan velge å integrere Klarna Checkout, som inkluderer finansiering som betalingsmetode. Du kan også bestemme deg for å integrere Finansiering som en frittstående betalingsmetode i din nåværende kasseløsning.

Plattformer

Klarna finansiering er tilgjengelig på de fleste e-handelsplattformer. Oppsettet er enkelt, og det vil ikke ta lang tid før du kan begynne å godta betalinger.

Utviklere dokumentasjon

Her finner du integrasjonsguider, API-dokumentasjon for de som ønsker å integrere direkte med systemene våre, og andre ting for å hjelpe deg i gang.

Detaljer.

Her finner du alle nitty-gritty detaljer når det gjelder integrasjon, funksjoner, ytelse og tjenesten.

Tjenesten

Tilgjengelige markeder | NO, US, UK, DE, AT, SE, FI |

Kundeautentisering | Inkludert |

Betalingsmetoder | 30 dagers faktura, PIX, 6-36 måneders finansiering, direktedebitering med Visa. |

Klarna kjøperbeskyttelse | Inkludert |

Klarna selgerbeskyttelse | Inkludert |

Forhandler får utbetaling innen | 3 uker etter at ordren sendes |

Integrasjon

E-handelsplattformer | |

Direkteintegrasjon via | Javascript and RestAPI |

Automatiske oppdateringer | Inkludert |

Utviklerdokumentasjon |

Hva mer?

Vi har flere løsninger og tjenester som kan interessere deg.

Betal nå

Tilby kort eller bankbetaling.

Å betale direkte tilbyr kundene en rask, sikker og brukervennlig tjeneste for direkte og automatiske betalinger.

Betal senere

Tilby 30 dager ekstra å betale.

La kundene dine prøve før de kjøper ved å tilby 30 dager ekstra for å fullføre betalingen uten ekstra kostnad.

Klar, ferdig, smoooth.

Choose your language and region

Klarna is available around the world with a variable offering, choose one that suits you best.

Copyright © 2005-2024 Klarna Bank AB (publ). Headquarters: Stockholm, Sweden. All rights reserved. Klarna Bank AB (publ). Sveavägen 46, 111 34 Stockholm. Organization number: 556737-0431