Find solutions

Resources

Customer login

Continue in browserBusiness login

Log in to manage your orders, payout reports, store statistics, and general settings.

Instalments

Interest free instalments.

Let your customers split the cost of their purchase into 3 monthly instalments, online and in-store.

The UK’s biggest brands let their shoppers pay in 3 instalments with Klarna.

Give your customers the financial freedom they deserve by letting them choose how and when to pay. Payment convenience and control for shoppers when they need it, on their terms.

How instalment payments work.

On each product page, shoppers learn that they can buy now and spread the cost over 3 monthly interest-free instalments.

1. At checkout

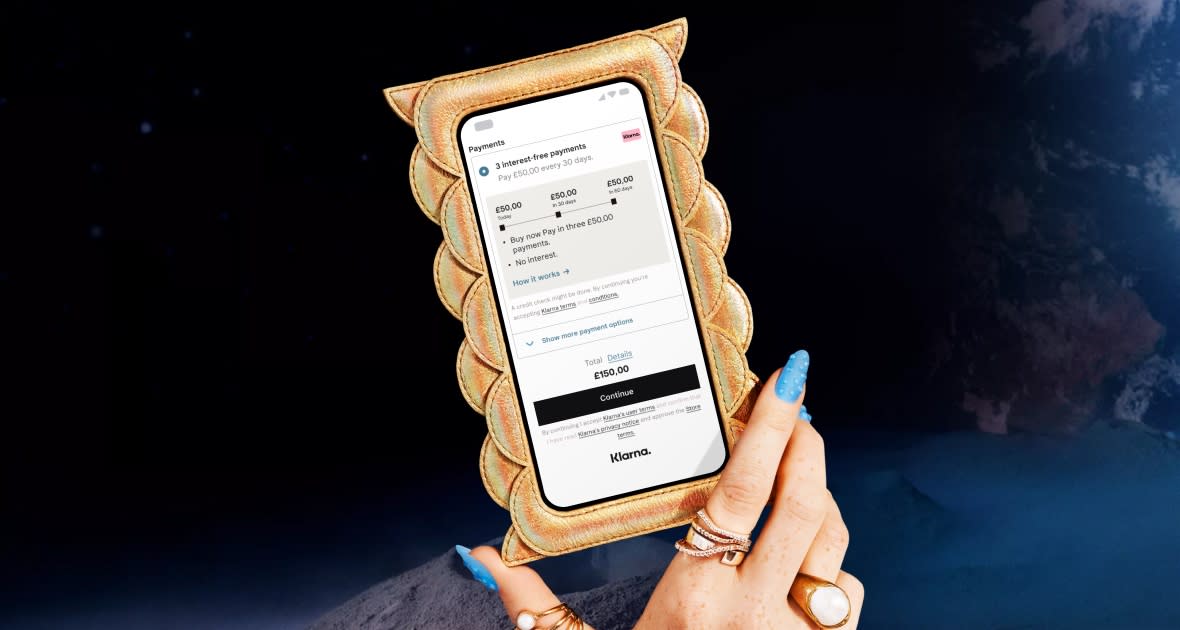

At checkout, the customer selects Klarna as their payment method. They will then see the option to pay using 3 Instalments along with the cost and payment schedule.

2. On shipment

Once the order is processed, Klarna pays you (the retailer) upfront and in full. We'll take care of collecting the payments from the shopper.

3. Post-purchase

Your shopper gets a clear overview of their purchases in the Klarna app and can easily manage their orders.

Effortless integration.

Getting up and running with Klarna is easy. We can quickly integrate with your existing technology platforms and payment partners. Need a custom solution? We can do that, too.

Details about 3 Instalments.

Let’s get down to the nitty-gritty. All you need to know about Klarna Instalments is right here.

Service

Market availability | UK |

Show/hide function | Included |

Payment period starts | When order is shipped |

Number of payments | 3 payments |

Time between payments | 30 days |

Consumer APR | 0%. No interest |

Consumer fees | No fees, when they pay on time |

Payments made | Automatically charged from specified card |

Klarna buyers protection | Included |

Klarna sellers protection | Included |

Credit broker licence | Not required. Unregulated product. |

Integration

Direct integration via | Javascript and RestAPI |

Auto updates | Included |

Dev resources |

Partnership

Max payment delay | 18 days |

Standard term of agreement | 36 months |

Pre-integrated e-commerce platforms |

What else?

We have more solutions and payment methods that might interest you. Read more about how and where you can sell with Klarna.

Financing

Offer up to 36 months to pay.

Give your customers the option to buy now and spread the cost with monthly payments, interest free or interest bearing.

Pay in 30 days

Offer an extra 30 days to pay.

Let your customers try before they buy by offering an extra 30 days to complete their payment, interest free.

Get Klarna customers shopping with you now. Are you ready?

Choose your language and region

Klarna is available around the world with a variable offering, choose one that suits you best.

Copyright © 2005-2024 Klarna. Klarna Financial Services UK Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”) for carrying out regulated consumer credit activities (firm reference number 987889), and for the provision of payment services under the Payment Services Regulations 2017 (firm reference number 987816). Klarna Financial Services UK Ltd offers both regulated and unregulated products. Klarna’s Pay in 3 instalments and Pay in 30 days agreements are not regulated by the FCA. Incorporated in England (company number 14290857), with its registered office at 10 York Road, London, SE1 7ND.