So funktioniert Klarna

Hilfe

Log-in für Kund:innen

WebversionHändlerportal

Managen Sie im Händlerportal Bestellungen, Abrechnungsberichte, Statistiken und allgemeine Einstellungen.

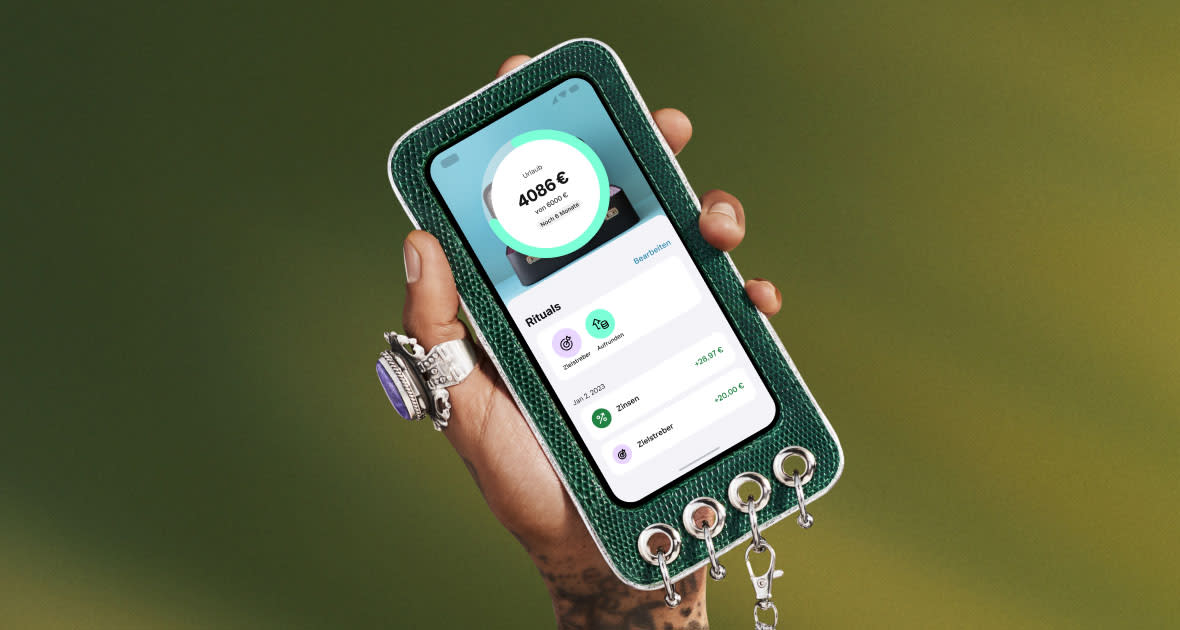

Klarna Pools

Sicher dir 3 %* Tagesgeldzinsen auf dein Geld in Pools. Haken? Gibt‘s nicht.

* Zinsänderungen vorbehalten.

Jetzt gibt’s 3 % Zinsen auf dein Geld in Pools

Ob Traumreise oder Geldpolster – eröffne ein Klarna Bankkonto und erstelle bis zu 3 Pools, um Geld zur Seite zu legen. Auf dein Guthaben in Pools erhältst du 3 % p. a. Tagesgeldzinsen, die monatlich ausgezahlt werden – kein Haken, kein Mindestbetrag, keine feste Laufzeit.

Das Konto ist gemäß einer Entscheidung der zuständigen schwedischen Behörde “Riksgälden” durch das schwedische Einlagensicherungssystem gedeckt. Die maximale Entschädigung für jeden Kunden beträgt 100.000 €, und die zuständige Behörde stellt die Entschädigung innerhalb von 7 Werktagen nach Beginn des Anspruchs auf Entschädigung zur Auszahlung bereit. Mehr erfahren.

So wird Sparen zur Gewohnheit

Gehe zu deinem Klarna Bankkonto in der Klarna App.

Erstelle in wenigen Sekunden einen neuen Pool.

Setz dir ein Sparziel.

Aktiviere Rituals wie Aufrunden oder regelmäßige Sparraten.

Erhalte Tagesgeldzinsen auf dein Erspartes und lehn dich zurück, während dein Erspartes wächst. Du kannst jederzeit flexibel auf dein Geld zugreifen.

Mit Sparzielen und automatisierten Rituals wird Sparen zur Routine. Das zahlt sich aus, denn mit Tagesgeldzinsen wachsen deine Ersparnisse noch schneller.

Das Bankkonto, das dir etwas zurückgibt

Du kannst das Klarna Bankkonto in wenigen Minuten direkt in der Klarna App eröffnen, deinen ersten Pool erstellen und dir Tagesgeldzinsen sichern. Das alles ohne Kontoführungsgebühren.

Lehn dich zurück und genieße die Übersicht

Spare und verwalte dein Geld dort, wo du shoppst – in der Klarna App. Verfolge deine Einnahmen und Ausgaben mit der praktischen Finanzübersicht. Setze Ausgabelimits mit wenigen Klicks und analysiere deine Ausgaben über Monate. So kannst du bewusster und effizienter sparen. Dein Geld unter deiner Kontrolle.

Noch Fragen?

Pools sind Unterkonten des Klarna Bankkontos. Um einen Pool zu erstellen, musst du also ein Klarna Bankkonto haben. Gehe in der Klarna App zu deinem Bankkonto und dann auf Pools. Hier findest du einen Überblick über deine Pools und kannst einen neuen erstellen.

Du kannst Pools jederzeit und so oft löschen und neu erstellen, wie du willst, aber maximal 3 Pools gleichzeitig haben.

Du möchtest einen Pool schließen? Öffne die Informationsseite deines Pools und tippe auf Einstellungen. Dort kannst du deinen Pool schließen. Um ihn schließen zu können, musst du das restliche Geld von deinem Pool auf dein Hauptkonto überweisen.

Nein, Pools sind kostenlos. Du erhältst sogar Zinsen.

Das Geld in deinen Pools wird verzinst, es gibt keine festen Laufzeiten. Die Zinsen werden täglich berechnet und monatlich auf deinen Pool ausgezahlt, das heißt, du profitierst jeden Monat vom Zinseszinseffekt.

In der App findest du stets den aktuellen Zinssatz und du kannst nachsehen, wie viel Zinsen seit der letzten Auszahlung aufgelaufen sind. Falls sich der Zinssatz ändert, wirst du per E-Mail benachrichtigt.

Es gibt keinen Mindestbetrag, ab dem du Zinsen bekommst, und du kannst in deinen bis zu 3 Pools jede Menge Geld zur Seite legen. Beachte, dass für einen Gesamtbetrag über 500.000 Euro in deinem Klarna Bankkonto Verwahrentgelt fällig wird. Mehr dazu findest du in unserem

.Gegebenenfalls anfallende Steuern wie Kapitalertragsteuer, Soli und Kirchensteuer werden automatisch einbehalten und abgeführt. Du brauchst dich also um nichts kümmern. Du kannst per App auch einen Freistellungsauftrag erteilen.

Geh in der Klarna App zu deinem Pool und öffne die Einstellungen oben rechts, um ein Sparziel hinzuzufügen. Du kannst den Betrag, den du sparen möchtest, sowie ein Zieldatum einstellen.

Übrigens: Falls du dein Sparziel nicht erreichen solltest, passiert nichts weiter. Das Feature soll dich in erster Linie beim Sparen unterstützen, dich dazu motivieren, dranzubleiben und deine Ziele zu erreichen.

Rituals sind automatisierte Features, die dir das Sparen erleichtern sollen. Öffne die Informationsseite deines Pools, um Rituals zu aktivieren, zu deaktivieren und zu bearbeiten.

Mit dem Ritual „Zielstreber” kannst du einen Betrag festlegen, der wöchentlich von deinem Klarna Bankkonto in deinen Pool geladen wird.

Beim Ritual „Aufrunden” wird dein Einkauf zum nächsten Euro aufgerundet und das Wechselgeld in deinem Pool gespart. Kostet der Einkauf zum Beispiel 5,30 Euro, wird auf 6 Euro aufgerundet, davon werden 70 Cent in deinen Pool geladen.

In diesem Fall wird kein Geld auf deinen Pool überwiesen. Stelle sicher, immer genug Geld auf deinem Klarna Bankkonto zu haben, damit du regelmäßig sparen kannst.

Geh in der App zu deinem Pool. Hier findest du die Option „Senden”. Gib den gewünschten Betrag ein und sende das Geld in Echtzeit auf dein Klarna Bankkonto.

Klarna Pools

Automatisiere dein Sparen

Choose your language and region

Klarna is available around the world with a variable offering, choose one that suits you best.

Copyright © 2005-2024 Klarna Bank AB (publ). Headquarters: Stockholm, Sweden. All rights reserved. Klarna Bank AB (publ). Sveavägen 46, 111 34 Stockholm. Organization number: 556737-0431