Find solutions

Customer login

Web versionBusiness login

Log in to manage your orders, payout reports, store statistics, and general settings.

Boost your business with Klarna.

Attract, convert, and retain customers with flexible payment options and performance-driven marketing.

global shoppers.

retail partners.

daily transactions.

Trusted by the world's most loved brands.

Businesses of all sizes grow with Klarna.

Select your estimated annual sales to see solutions that work for your business.

Less than $3M annual sales.

Give customers more time to pay, while you get paid in full - upfront. It's a win-win.

More than $3M annual sales.

Give your customers financial freedom with flexible payment options - and attract new shoppers through our suite of performance-driven marketing solutions.

Payment and marketing solutions that make an impact.

For businesses of all sizes.

Payment solutions.

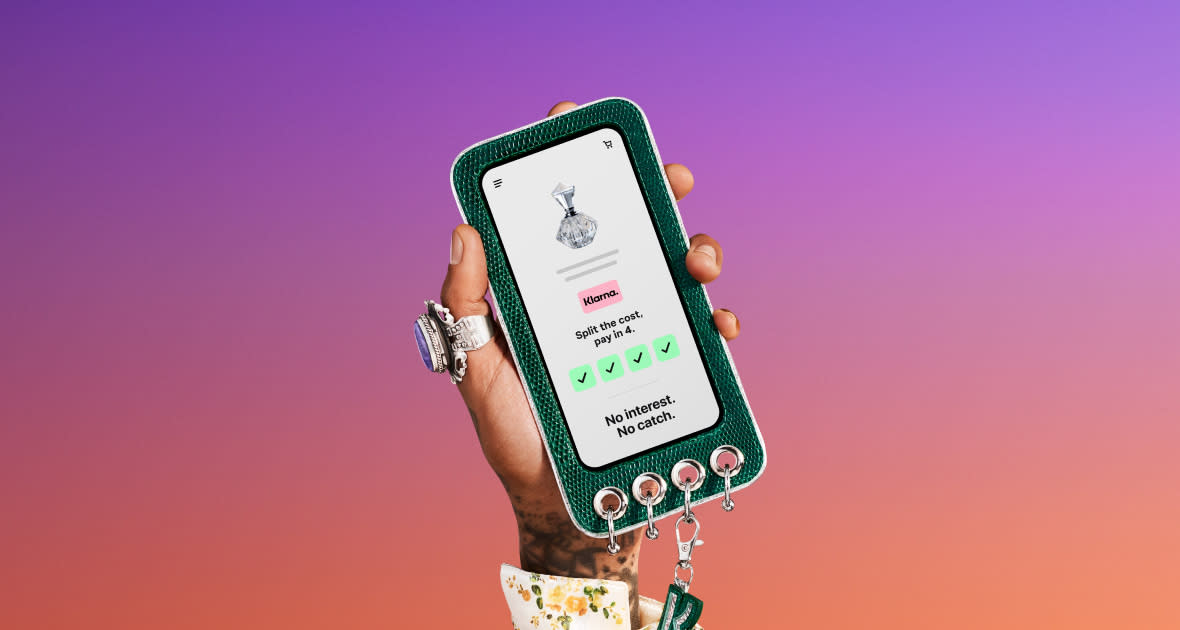

Offer Klarna's buy-now-pay-later products, like Pay in 4, Pay in 30 days, and Financing to give your customers the ultimate flexibility and keep them coming back for more. Once you become our partner, we'll continually drive new customers to you from our app, website, and other channels. For businesses of all sizes.

41% increase in average order value

30% increase in conversion

Up to 40% of Klarna sales come from new customers

For enterprise.

Marketing solutions.

Turn our high-intent shoppers into loyal customers with performance-driven marketing solutions. Leverage AI-powered technology to deliver shoppable content that sells. Optimize your campaigns to meet your marketing goals and drive profitable growth. For businesses with annual sales of $3M and up.

40M high-intent US shoppers

Up to 70% increase in revenue

Up to 25% increase in return on ad spend

Meet the world’s greatest shoppers.

We create omnichannel marketing plans that put your brand in front of Klarna's highly engaged customers. Our retail partners see up to 40% of Klarna shoppers are new to their brand.

40M

shoppers in the US (and growing).

70%

are Gen Z and Millennial.

45%

higher purchase frequency than the average shopper.

What our retail partners are saying.

Jeff Gennette, CEO at Macy's

"Customers, particularly younger ones, were asking for a buy now, pay later option...If we didn't have it, they might have gone elsewhere... 40% of shoppers using Klarna were new to Macy's."

Carolyn Bojanowski, SVP & GM of E-commerce at Sephora US

"A trend that we are seeing a lot of success with is Klarna. This idea of having flexibility in payments is super important and something we want to offer to our clients."

Helen Keighley, UK Affiliate Manager at Made.com

"The level of traffic and new customers Klarna has helped us to acquire via our affiliate partnership is particularly impressive. We value Klarna as a key partner for capturing new audiences and we're excited to see our partnership grow."

Explore tools for your business.

Less than $3M annual sales.

More than $3M annual sales.

Choose your language and region

Klarna is available around the world with a variable offering, choose one that suits you best.

Monthly financing through Klarna and One-time card bi-weekly payments with a service fee to shop anywhere in the Klarna App issued by WebBank. Other CA resident loans at select merchants made or arranged pursuant to a California Financing Law license. Copyright © 2005-2024 Klarna Inc. NMLS #1353190, 800 N. High Street Columbus, OH 43215. VT Consumers: For WebBank Loan Products (One-Time Cards, Financing, Klarna Card): THIS IS A LOAN SOLICITATION ONLY. KLARNA INC. IS NOT THE LENDER. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR LOAN INQUIRY. THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS. THE LENDER MAY BE SUBJECT TO FEDERAL LENDING LAWS.