Find solutions

Customer login

Web versionBusiness login

Log in to manage your orders, payout reports, store statistics, and general settings.

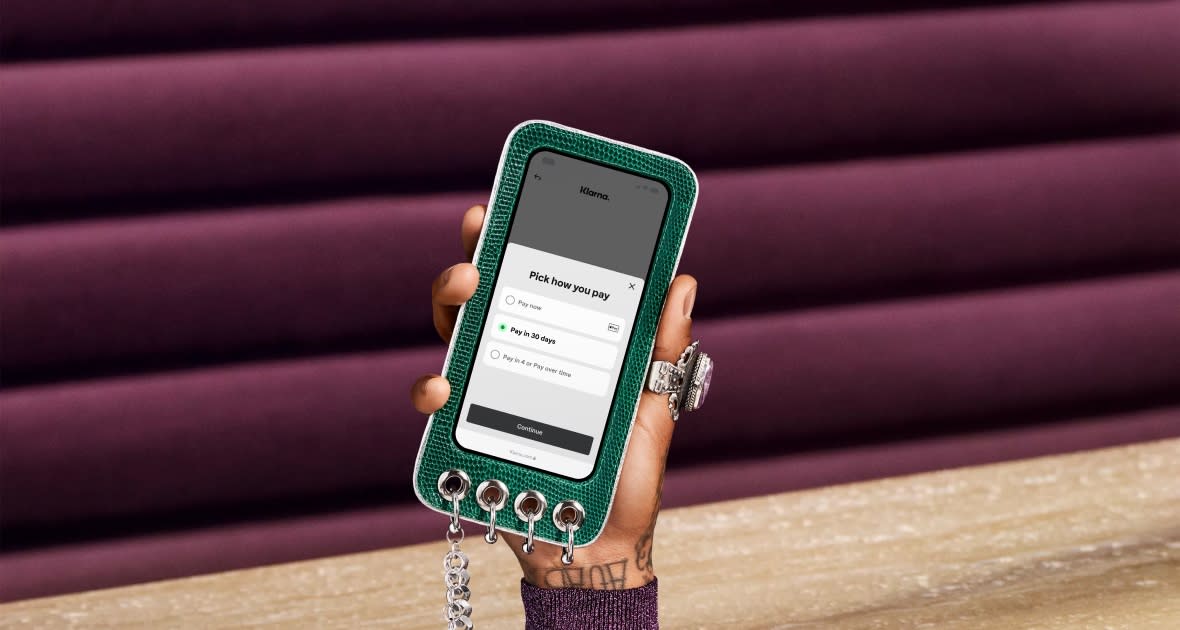

Pay in 30 days

Let customers try before they buy.

Offer your customers extra confidence to shop when they place their orders and pay in 30 days — after they've already tried, and come to love, your products.

The world’s top brands are using Pay in 30 Days to increase sales.

Pay in 30 days gives your customers the online shopping freedom of paying up to 30 days later without interest or any upfront fees. You’ll get happier returning customers. And a boost in sales.

23%

increase in average order value with Klarna’s Pay in 30 days.

47%

increase in order frequency compared to shoppers paying by card.

How Pay in 30 days works.

On the product page, your customers learn that they can pay for their order after receiving it.

1. At checkout

With simple top-of-mind information, the purchase is completed within seconds. No upfront payment required.

2. On shipment

The order is activated by the retailer and the customer’s payment period starts. Klarna pays you (the retailer) upfront and in full. We'll take care of collecting the rest from the shopper.

3. Post-purchase

Your shopper gets a clear overview of their purchases in the Klarna app and can easily manage their orders or make new ones.

Press

Klarna x H&M.

We’ve started boosting e-commerce and loyalty for H&M.

Effortless integration.

Getting up and running with Klarna is easy. We can quickly integrate with your existing technology platforms and payment partners. Need a custom solution? We can do that, too.

Details about Pay in 30 days.

Let’s get down to the nitty-gritty. All you need to know is right here.

Service

Market availability | US, UK, DE, NL, SE, NO, FI, DK |

Show/hide function | Included |

Payment period starts | When order is shipped |

Number of payments | 1 payment |

Payment term | 30 days |

Consumer APR | 0% — no interest |

Consumer fees | No upfront fees |

Payments made | Manually paid online or in app |

Zero-fraud liability | Included |

Klarna seller protection | Included |

Integration

Direct integration via | Javascript and RestAPI |

Auto updates | Included |

Dev resources |

Partnership

Max payment delay | 3 business days after order is shipped |

Standard term of agreement | 36 months |

E-commerce platforms |

See legal

What else?

We have more solutions and payment methods that might interest you. Read more about how and where you can sell with Klarna.

Pay in 4 Installments

4 interest-free payments.

Give shoppers the freedom to spread the cost interest-free over time. You get paid immediately and shoppers get a flexible plan.

Financing

Offer up to 24 months to pay.

Give your customers the flexible option to buy now and spread the cost with monthly payments.

Pay in 30 days

Offer an extra 30 days to pay.

Let your customers try before they buy by offering an extra 30 days to complete their payment. No fees.

Get more customers who shop more, more often. Are you ready?

Choose your language and region

Klarna is available around the world with a variable offering, choose one that suits you best.

Monthly financing through Klarna and One-time card bi-weekly payments with a service fee to shop anywhere in the Klarna App issued by WebBank. Other CA resident loans at select merchants made or arranged pursuant to a California Financing Law license. Copyright © 2005-2024 Klarna Inc. NMLS #1353190, 800 N. High Street Columbus, OH 43215. VT Consumers: For WebBank Loan Products (One-Time Cards, Financing, Klarna Card): THIS IS A LOAN SOLICITATION ONLY. KLARNA INC. IS NOT THE LENDER. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR LOAN INQUIRY. THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS. THE LENDER MAY BE SUBJECT TO FEDERAL LENDING LAWS.